how much taxes does illinois take out of paycheck

For 2022 the limit for 401 k plans is 20500. If you increase your contributions your paychecks will get smaller.

Capitol Fax Com Your Illinois News Radar Mobile Edition

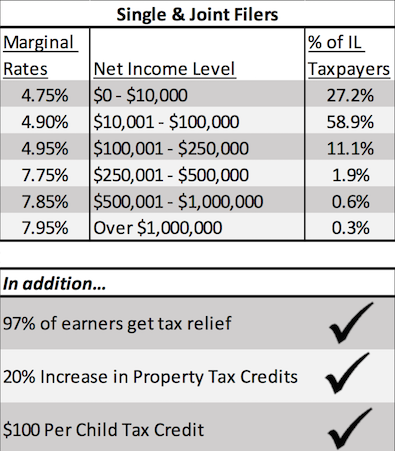

As of 2018 the state income tax rate for Illinois is 495 percent of income after deducting for allowances the employee claims on IL-W-4.

. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid. No Illinois cities charge a local income tax. If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our Taxpayer Assistance Division at 1 800 732-8866 or 1 217 782-3336.

Details of the personal income tax rates used in the 2022 Illinois State Calculator are published below the. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. According to the Illinois Department of Revenue all incomes are created equal.

Youll use your employees IL-W-4 to calculate how much to withhold from their paycheck. This article is part of a larger series on How to Do Payroll. Everyones income in Illinois is taxes at the same rate due to the states flat income tax system of 495.

Unless an employee submits a Form W-4 claiming exemption the employer must deduct federal income tax. How much tax is taken out of a 500 check. Employers are responsible for deducting a flat income tax rate of 495 for all employees.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois. An hourly employee is paid at an hourly rate for the pay period.

What Taxes Are Taken Out of a Paycheck in Illinois. For wages and other compensation subtract any exemptions from the wages paid and multiply the result by 495 percent. If you pay salaried employees twice a month there are 24 pay periods in the year and the gross pay for one pay period is 1250 30000 divided by 24.

How much is 60000 a year after taxes in Illinois. Published January 21 2022. In Illinois the Supplemental wages and bonuses are charged at the same state income tax rate.

Both employers and employees are responsible for payroll taxes. Employers can find the exact amount to deduct by consulting the tax tables in Booklet IL-700-T. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator.

The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings. The Waiver Request must be completed and submitted back to the Department. What taxes come out of paychecks in Illinois.

The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income Tax Rates and Thresholds in 2022. Generally the rate for withholding Illinois Income Tax is 495 percent. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return.

Its important to note that there are limits to the pre-tax contribution amounts. However if upon termination an employee owes an amount greater than 15 of gross wages that amount may be withheld from the employees final compensation but only if such arrangement was included in. Also not city or county levies a local income tax.

Helpful Paycheck Calculator Info. A 2020 or later W4 is required for all new employees. Illinois Hourly Paycheck Calculator.

How much is payroll tax in Illinois. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020.

Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Switch to Illinois hourly calculator.

For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions. During the course of employment no cash advance repayment agreement can provide a repayment schedule of more than 15 of an employees wages per paycheck. Personal income tax in Illinois is a flat 495 for 20221.

How much taxes does illinois take out of paycheck Sunday February 27 2022 Edit Each pay period 62 of your paycheck goes to your share of Social Security taxes and 145 goes to.

The Illinois Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing

Irs Tax Refund Status Illinois Residents Still Waiting For Federal Tax Refunds 9 Months After Filing Abc7 Chicago

Illinois Paycheck Calculator Smartasset

New Tax Law Take Home Pay Calculator For 75 000 Salary

Illinois Has The Highest Taxes Nationwide Report Finds Mystateline Com

Celebrating America Saves Week 7 Ways To Automate Your Savings Plan Well Retire Well How To Get Money Money Financial Financial Help

Would Plan To Suspend Gas Tax Help

Illinois Paycheck Calculator Updated For 2022

Illinois Salary Calculator 2022 Icalculator

Where S My Illinois State Tax Refund Taxact Blog

I Have A Monthly Wage Of 1 000 But Need To Pay Tax At 220 So I Just Have 780 In The End Is This Kind Of Tax Rate Common In Illinois Quora

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Tax Property